19+ Va mortgage lenders

VA Partial Claim Program Purpose. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

Brentwoodpress 12 27 19 By Brentwood Press Publishing Issuu

COVID-19 Small Business Loans and Assistance.

. However we qualify approve and close borrowers who were denied at other mortgage companies. Q15 If an educational institution or program temporarily ceases operation due to the COVID-19 emergency what steps should the school take. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Online mortgage lenders offer convenience automation and digital tools. Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018. VA Home Loans are provided by private lenders such as banks and mortgage companies.

At Gustan Cho Associates we only market mortgage loan products that exists and are possible. The VA Partial Claim Payment VAPCP is a temporary program that is intended to assist Veteran borrowers specifically impacted by the COVID-19 pandemic to resume making their regular pre-COVID mortgage payments after exiting forbearance. This guide can help you under the homebuying process and how to.

Before you buy be sure to read the VA Home Loan Buyers Guide. Mortgage loan basics Basic concepts and legal regulation. 175 of loan amount upfront and 085 annually.

Homeowner Tax Deductions. 25-0000 Educational Instruction and Library Occupations. Second mortgage types Lump sum.

B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not. A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020. Best for VA loans.

Your Guide To 2015 US. They are backed by the Department of Veterans Affairs VA and offered by private lenders like Freedom Mortgage. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

New Loan Comparison and Certification. Over 75 of our clients are folks who could not qualify at other lenders. Keep in mind that a federal regulation promulgated under the Real Estate Settlement Procedures Act prohibits most mortgage servicers from taking the first step to initiate a judicial or non-judicial foreclosure under any state law until at least 120 days have passed since the borrower.

VA loans can help you buy a home refinance a home or get cash from your homes equity to spend on renovations or education. We are a national mortgage company licensed in multiple states with no lender overlays. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The funding fee to refinance a prior VA loan is a minimal 050. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

To help you find the best mortgage lender in Texas for your situation NerdWallet has reviewed and picked some of the best lenders in a variety of categories. This may not apply if you were already behind on your mortgage when the COVID-19 forbearance was requested. VA loans for current and veteran military members dont require a down payment or mortgage insurance.

If a student has questions related to the impact of COVID-19 on their education benefits have them call 888-GIBILL-1 888-442-4551 between 8 am. See VA Lenders Handbook Chapter 4 Section 17. It insures mortgage loans from FHA-approved lenders against default.

VA guarantees a portion of the loan enabling the lender to provide you with more favorable terms. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. First-time home buyer grants.

Veterans may be eligible for refinancing their VA mortgage using an Interest Rate Reduction Refinancing Loan IRRRL. To apply for an FHA-insured loan you will need to use an FHA-approved. Compare current VA mortgage rates from lenders in your area.

Native American Veterans must pay a low funding fee of 125 to obtain VAs direct loan to purchase a home. Its the same for just about every customer. Flagstar Bank offers all the major mortgage options conventional jumbo construction and government-backed loans both online and at its branch locations in Indiana Michigan Ohio and Wisconsin.

And home equity lines of credit and jumbo mortgages were suspended due to the COVID-19 pandemic. Read our guide for buying a home. VA loan rates are updated daily.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Borrowers have the option to finance the VA funding fee or pay it in cash but the funding fee must be paid at the time of loan closing. Fannie Mae HomePath.

Lenders must include with every Interest Rate Reduction Refinance loan a statement signed by the borrowers showing they understand the effects of the refinance. For FHA VA and USDA loans the mortgage insurance rate is pre-set. 27-0000 Arts Design Entertainment Sports and Media Occupations.

VAPCP will only be available from July 27 2021 through October 28 2022. 21-0000 Community and Social Service Occupations. Please visit the trouble making payments web page if you have financial trouble or some other circumstance regarding your VA home loan.

During the COVID-19 national emergency however if you were current on your mortgage when the COVID-19 forbearance was granted your mortgage company should report your account as current. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. The 30-year fixed-rate mortgage is 19 basis points higher than one week ago and 329 basis points.

If you are a borrower and want to contact the VA Loan Guaranty Office regarding any aspect of your mortgage please call 1-877-827-3702 with hours of operation from 8am to 6pm EST. It may be that your mortgage company has to. Compare our picks for best VA mortgage lenders of 2022.

Lenders may use this sample document provided it is on the lenders letterhead. 19-0000 Life Physical and Social Science Occupations. State COVID-19 related housing actions March 1 2022.

For mortgage lenders we take into account each companys customer service ratings interest rates loan product availability minimum down payment minimum FICO score and online features. We can help you understand the benefits of VA loans and empower you on your homeownership journey.

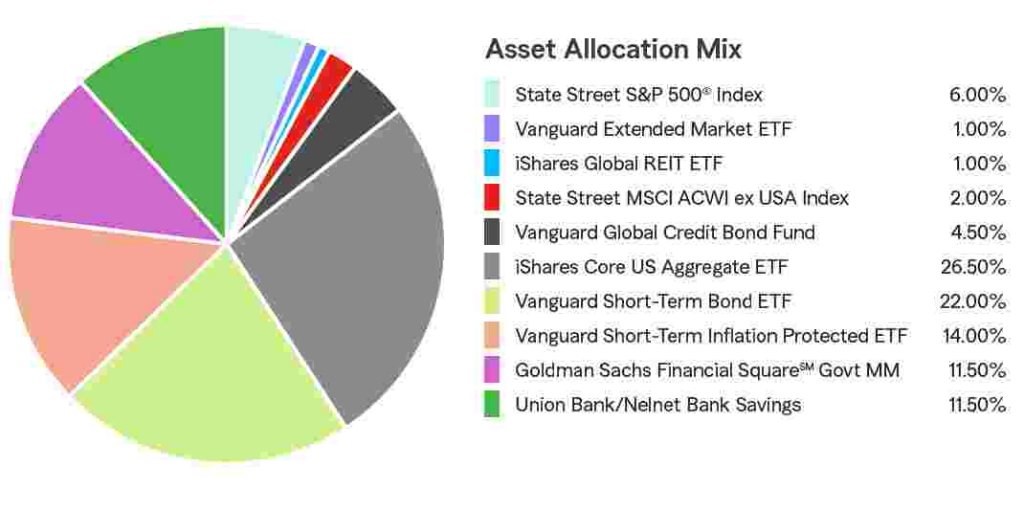

State Farm 529 Savings Plan Age Based 19 Plus Portfolio State Farm

Covid 19 Marvin Lim For Ga

Real Estate Exam Cheat Sheet Real Estate Exam Real Estate Test Real Estate Tips

Covid 19 Marvin Lim For Ga

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

8zms63zlxutc9m

Reviews About Quicken Loans

Matt Pearl Thesdappraiser Twitter

Jordan Points Mortgage Loan Officer Certainty Home Loans Linkedin

Jordan Points Mortgage Loan Officer Certainty Home Loans Linkedin

6 Mortgage Contract Templates Free Sample Example Format Download Free Premium Templates

Jordan Points Mortgage Loan Officer Certainty Home Loans Linkedin

The Aaron Duez Team Home Facebook

Lenea Waldman Tupelo Ms Mortgage Lender Trustmark

Reviews About Quicken Loans

6h8mwj8c4eoqbm

Dave Cotner Licensed Mortgage Loan Officer